South of Scotland Enterprise - Economic Intelligence Report

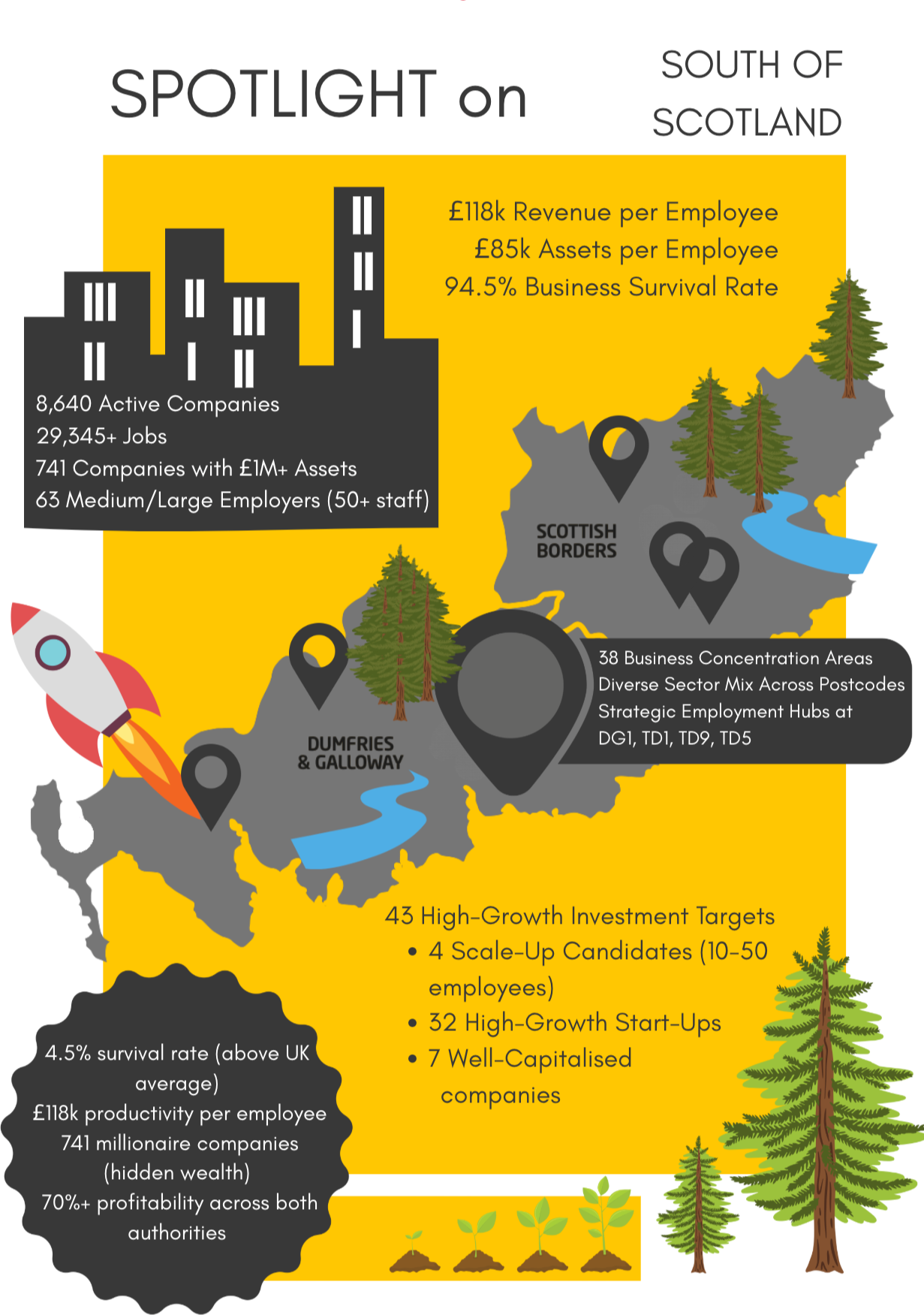

Spotlight on South of Scotland companies visual

SUMMARY

This report provides financial analysis of 1,673 companies within three significant sectors in the South of Scotland ecosystem, representing 19% of the region's 8,640 total active companies. Our analysis reveals growth potential and financial resilience amongst businesses in manufacturing, construction & housing, and property & rental sectors.

Key findings for economic development: 47.3% of priority sector companies (792 businesses) are actively growing assets, with 97 companies achieving the optimal "Rapid Growth + Debt Reduction" profile ideal for partnership and support programmes. 10.8% (180 companies) show signs of financial distress requiring intervention.

Strategic opportunity: These priority sectors collectively generated £25.5M net asset growth, demonstrating significant economic momentum that targeted support could accelerate further.

SCOPE & METHODOLOGY

Analysis Focus

Total regional companies: 8,640 active businesses across all sectors

Companies analysed: 1,673 businesses in SOSE's three important sectors

Geographic coverage: Scottish Borders and Dumfries & Galloway

Data source: Companies House electronic filings

Priority Sectors Analysed

Manufacturing: 359 companies (21.5% of analysed sample)

Construction & Housing: 762 companies (45.5% of analysed sample)

Property & Rental: 552 companies (33.0% of analysed sample)

Financial Metrics Examined

Year-on-year asset growth rates and debt management patterns

Employment efficiency and productivity indicators

Financial transformation categories for targeted intervention

Business resilience and investment readiness assessment

REGIONAL ECONOMIC CONTEXT

(Full regional dataset - 8,640 companies)

Overall Business Landscape

8,640 active companies across all sectors in South Scotland

29,345 jobs supported across the regional economy

741 companies with assets exceeding £1M demonstrating substantial regional wealth

63 medium to large employers (50+ staff) providing economic stability

Regional Productivity Indicators

£118k revenue per employee average across reporting companies

£85k assets per employee demonstrating capital efficiency

94.5% business survival rate significantly above national averages

INDIVIDUAL SECTOR PERFORMANCE

(Sector analysis - 1,673 companies)

Financial Health Overview

792 companies (47.3%) actively growing assets - substantial growth momentum

587 companies reducing debt whilst expanding - excellent financial discipline

365 companies achieving high growth (20%+ asset expansion) - scale-up candidates

£25.5M net asset growth across the three priority sectors

Investment Readiness Categories

97 "Rapid Growth + Debt Reduction" companies - optimal partnership targets

118 "Healthy Growth" companies - sustainable expansion candidates

180 "Struggling" companies (10.8%) - intervention opportunities

Regional resilience rate: 89.2% of companies stable or growing

Sector-Specific Analysis

Manufacturing Sector (359 companies)

178 companies (49.6%) growing assets - strongest growth rate across sectors

82 high-growth companies with 20%+ asset expansion

110 companies reducing debt whilst growing - financial discipline leaders

21 "Rapid Growth + Debt Reduction" companies ready for partnership

Construction & Housing Sector (762 companies)

357 companies (46.7%) growing assets despite challenging market conditions

186 high-growth companies demonstrating housing delivery capacity

103 exceptional growth companies (50%+ asset expansion) - transformation leaders

45 "Rapid Growth + Debt Reduction" companies - largest pool of partnership candidates

Property & Rental Sector (552 companies)

257 companies (46.6%) growing assets with superior debt management

97 high-growth companies indicating commercial property market strength

231 companies actively reducing debt - financial sophistication leaders

31 "Rapid Growth + Debt Reduction" companies - quality investment targets

STRATEGIC OPPORTUNITIES

Priority Interventions

Engage 97 "Rapid Growth + Debt Reduction" companies for immediate partnership programmes

Develop scale-up support for 365 high-growth companies demonstrating 20%+ expansion

Implement targeted intervention for 180 struggling companies to prevent economic loss

Leverage £25.5M growth momentum through strategic investment and support

Sector-Specific Opportunities

Manufacturing: 49.6% growth rate offers export development and innovation potential

Construction: 103 exceptional growth companies ready for major housing delivery projects

Property: Superior debt management indicates mature commercial property market

DATA VERIFICATION

All figures independently verifiable through:

Companies House electronic filing records

Company registration numbers provided for direct validation

Financial data extracted from filed accounts

Geographic classification verified through postcode analysis

Confidence levels: Analysis based on financial records for all 1,673 companies in defined sectors registered within the South of Scotland.

BESPOKE ECONOMIC INTELLIGENCE

This analysis demonstrates the depth of insight available through comprehensive company financial data analysis. For organisations requiring tailored economic intelligence reports covering specific sectors, geographic areas, or business development opportunities, please contact us to discuss your requirements.

Our methodology can be applied to any UK region or sector combination, providing the competitive advantage that comes from understanding your local business ecosystem at an unprecedented level of detail.