Financial Resilience in the South of Scotland: Industry Transformations Revealed

Data represents average figures per company across the south of Scotland industries with significant change in equity or liabilities.

The economic landscape of the South of Scotland is experiencing remarkable shifts, with certain industries demonstrating extraordinary financial resilience while others face mounting challenges. Our latest analysis of our financial data from businesses across the region reveals compelling patterns of transformation that offer valuable insights for investors, business leaders, and policymakers.

Dramatic Turnarounds: The Recovery Stories

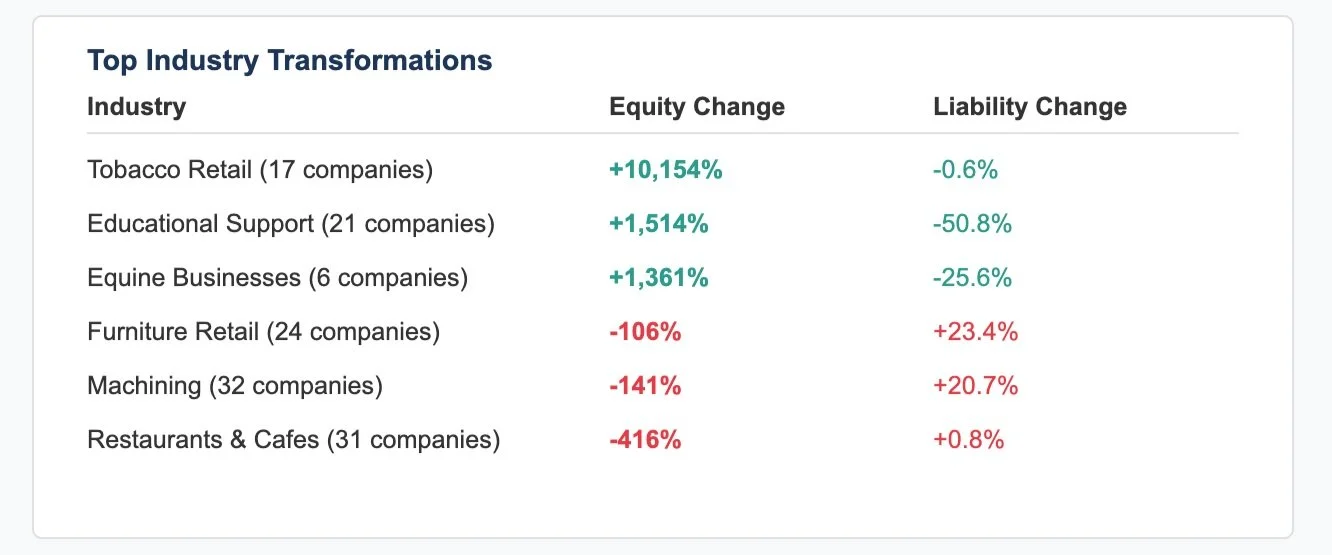

Perhaps the most striking finding in our analysis is the number of industries that have completely reversed their financial fortunes. Five sectors have transformed from negative to positive equity positions:

Tobacco retail has achieved a remarkable turnaround, moving from an average negative equity of -£126 to a positive £12,685 per business, while simultaneously reducing liabilities slightly.

Educational support services have not only shifted to positive equity (£3,213) but also slashed their liabilities by half (50.8% reduction), demonstrating both operational improvement and strategic debt management.

Equine businesses have similarly transformed their balance sheets, moving to an average positive equity of £6,951 while reducing their substantial liabilities by 25.6%.

Furniture manufacturing has bounced back from negative equity to achieve a healthy £9,244 position with an 8.1% reduction in liabilities.

Performing arts organisations have reached break-even territory, though this has come with a significant 42.7% increase in liabilities, suggesting substantial new investment in the sector.

Concerning Reversals: Sectors Under Pressure

Conversely, four industries have experienced the opposite journey, falling from positive to negative equity positions:

Physical wellbeing activities (including fitness and wellness businesses) have declined dramatically from £422 to -£2,328 average equity, despite reducing their liabilities by 8.3%.

Restaurants and cafes have seen a similar reversal, moving from £1,007 to -£3,182 equity, reflecting the continued challenges facing hospitality businesses despite the post-pandemic recovery period.

Machining operations show perhaps the most concerning trend, plummeting from £25,695 to -£10,495 average equity while simultaneously increasing liabilities by 20.7%.

Furniture retail has experienced a complete reversal, moving from a substantial positive equity position (£148,300) to negative territory (-£9,381), while also taking on 23.4% more debt.

The Middle Ground: Declining but Stable

A number of industries maintain positive equity positions but show significant declines:

Social work services for the elderly remain well-capitalised (£124,330 average equity) but have seen a 33.9% decline, possibly reflecting changing funding environments or increased operational costs.

Sports activities businesses maintain substantial assets (£58,211 equity) but show a 27.8% decline with slightly increasing liabilities.

Quantity surveying has seen equity decline by 51.7% but has compensated with a dramatic 68.4% reduction in liabilities, suggesting strategic restructuring.

Regional Economic Implications

These financial patterns reveal several important trends for the south of Scotland's economy:

Service Sector Divergence: While educational services are thriving, hospitality and wellbeing businesses continue to struggle, indicating a significant shift in consumer spending patterns.

Manufacturing Resilience and Retail Decline: Furniture manufacturing has recovered well, while furniture retail has collapsed, highlighting the changing dynamics between production and distribution sectors.

Strategic Debt Management: The most successful businesses have simultaneously improved equity positions while reducing liabilities – a challenging balancing act that demonstrates sophisticated financial management.

Scale Advantages: Larger, more capitalised sectors (such as social work and sports activities) have weathered financial pressures better, maintaining positive equity despite significant percentage declines.

Looking Forward: Opportunities and Challenges

These financial shifts highlight several opportunities for targeted support and investment:

Educational services appear well-positioned for growth and could become a cornerstone of regional economic development.

Hospitality and wellbeing businesses require urgent support to address structural financial challenges that predate and have been exacerbated by recent economic pressures.

Machining operations show alarming financial deterioration that warrants investigation and potential intervention.

Creative sectors like performing arts show promise but appear to be relying heavily on increased debt, suggesting a need for sustainable business model development.

The Data

Equity Changes and Liability Management (Current vs previous financial accounting years)

| Industry | Ltd Companies registered | Equity Change | Liability Change | Financial Profile |

|---|---|---|---|---|

| Tobacco Retail | 17 | -10,153.6% | -0.6% | Remarkable turnaround with controlled liabilities |

| Educational Support | 21 | -1,513.8% | -50.8% | Strong recovery with significant debt reduction |

| Equine Businesses | 6 | -1,361.1% | -25.6% | Successful turnaround with reduced debt |

| Furniture Manufacturing | 8 | -262.7% | -8.1% | Strong recovery with modest liability reduction |

| Performing Arts | 18 | -125.2% | +42.7% | Break-even with significant new investment |

| Specialist Photography | 6 | -87.7% | -4.0% | Declining but still positive equity |

| Crop Production Support | 28 | -66.2% | +4.7% | Declining returns with increasing debt |

| Non-trading Companies | 10 | -63.6% | +36.4% | Sharp decline with substantial debt increase |

| Quantity Surveying | 19 | -51.7% | -68.4% | Equity decline offset by major liability reduction |

| Perfume Manufacturing | 16 | -50.2% | +30.0% | Significant decline with increasing debt |

| Medical Practices | 9 | -39.0% | +24.0% | Moderate decline with growing liabilities |

| Facilities Support | 19 | -35.4% | -37.9% | Declining profits offset by debt reduction |

| Social Work (Elderly) | 21 | -33.9% | -9.0% | Capital-intensive with declining returns |

| Sports Activities | 58 | -27.8% | +4.9% | Substantial assets with declining performance |

| Physical Wellbeing | 11 | -651.0% | -8.3% | Sector in distress despite reducing debt |

| Restaurants & Cafes | 31 | -415.8% | +0.8% | Significant decline with flat liabilities |

| Machining | 32 | -140.9% | +20.7% | Severe decline with increasing debt |

| Furniture Retail | 24 | -106.3% | +23.4% | Complete reversal with growing liabilities |

| Motor Vehicle Manufacturing | 16 | +63.1% | -65.8% | Improving but still negative equity |

| Event Catering | 12 | +27.2% | -15.2% | Improving but remains in financial distress |

Data represents average figures per company (registered in the Scottish Borders and Dumfries and Galloway) industries with 5+ companies. Equity change % represents year-on-year movement.

Conclusion

The south of Scotland's industrial landscape is experiencing profound change. Understanding these financial patterns provides crucial intelligence for those seeking to strengthen the region's economic resilience and capitalise on emerging opportunities.

The transformation stories – both positive and negative – demonstrate that local businesses are not passive recipients of economic conditions but are actively restructuring, refinancing, and reimagining their operations in response to changing market dynamics.

For policymakers and business support organisations, these insights offer a roadmap for targeted intervention that could help struggling sectors while building on the momentum of those demonstrating remarkable resilience.